This article is co-written by Ing. Werner Krauss – see information below

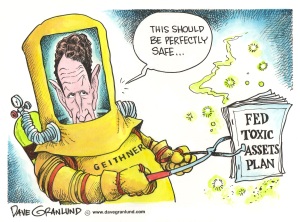

Cartoon: © Dave Granlund, www.davegranlund.com

The Problem of ‘Toxic Assets’

“Our job is to fix the problem in the financial sector at the least risk to the taxpayer,” U.S. Treasury Secretary Timothy Geithner stated the objective on Mar. 23. Supported by President Barack Obama, Geithner unveiled yet another bailout plan for the struggling U.S. financial system.

Rumours had it, that the Obama Administration would revive a plan that the Bush Administration had drafted in September 2008 but put back into the draw: Spending billions of U.S. dollars taxpayers’ money to free the financial system of ‘legacy assets’ – real estate loans as well as securities backed by loan portfolios – colloquially known as ‘toxic assets.’

Those assets cause “uncertainty around the balance sheets of these financial institutions, compromising their ability to raise capital and their willingness to increase lending,” so the Fact Sheet of the Public-Private-Investment Program of the U.S. Treasury, which confirms what has been rumored in early March.

According to the new bailout strategy, the U.S. government will spend yet another staggering U.S. $ 75 – 100 billion in order to help raise $ 1 trillion as to stimulate the economy and ‘flush’ the U.S. financial system of the ‘toxic assets.’

Geithner admitted that this plan fuels public anger as Wall Street seems to benefit at times where average Americans suffer. The financial sector has indeed been a major recipient to previous support: As an example, the Troubled Assets Relief Program (TARP) worth more than U.S. $ 700 billion, included $ 25 billion packages each for Citigroup, J.P. Morgan Chase and Well Fargo, the largest amounts ever given to any bank, among others.

“The (public) anger and outrage is perfectly understandable,” and he firmly added that “we have to make sure our assistance is not going to award failures.”